Navy Federal Credit Union (NFCU) is a United States credit union that serves members of the military, veterans, and their families. NFCU is the largest credit union in the United States in terms of both membership and assets. The credit union was founded in 1933 and is headquartered in Vienna, Virginia. NFCU offers a variety of financial products and services, including checking and savings accounts, loans, credit cards, and investment services.

In this guide, Cuban VR will focus on the meaning of “prequalification”, the benefits of the Navy Federal Prequalification Credit Card, and how to apply for it. In as much as you can apply for a navy Federal Credit Card online, it is important to know more about the preapproval that exists. So, whether you’re looking for how to get Navy Federal $25,000 credit card or the best time to apply for Navy Federal Credit card and everything in between, you will find this article helpful.

What is Prequalification?

Prequalification is a process that allows you to see if you’re eligible for a credit card without impacting your credit score. When you apply for a credit card, the issuer will typically run a hard credit check, which can lower your credit score. However, with prequalification, the issuer only performs a soft credit check, which doesn’t impact your credit score.

Prequalification is a great way to determine which credit cards you may qualify for before you apply. This can help you avoid applying for cards you’re not likely to be approved for, which can hurt your credit score.

Benefits of the Navy Federal Prequalification Credit Card

The Navy Federal Prequalification Credit Card offers several benefits that are tailored to meet the needs of military personnel, veterans, and their families. Here are some of the benefits of this card:

- No annual fee: The Navy Federal Prequalification Credit Card has no annual fee, which means you won’t have to pay to use the card.

- Competitive interest rates: The interest rates on the Navy Federal Prequalification Credit Card are competitive, which can save you money on interest charges if you carry a balance.

- Rewards program: The card offers a rewards program that allows you to earn points on your purchases. You can redeem your points for travel, merchandise, and more.

- Military-specific benefits: The card offers benefits that are specific to military personnel, such as no foreign transaction fees, travel and emergency assistance, and special discounts on travel and entertainment.

How to apply for the Navy Federal Prequalification Credit Card

The application process for the Navy Federal Credit Card is easy. Simply follow the steps by step guide below;

Step #1: You have to become a member of the Navy Federal before you can proceed.

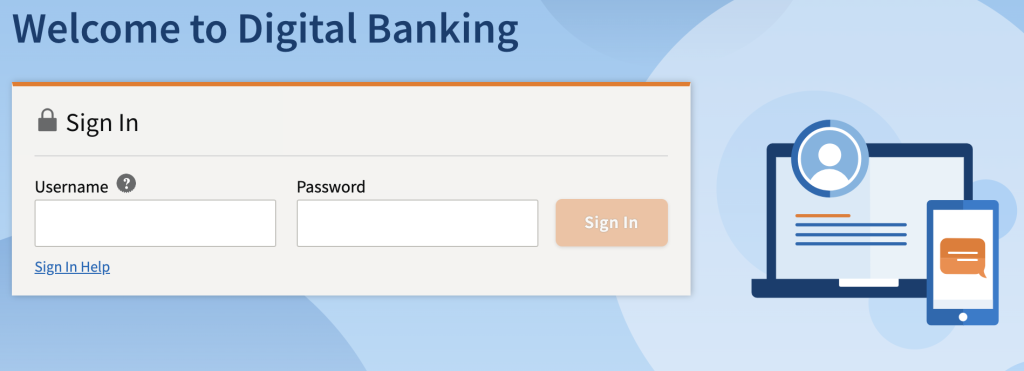

Step #2: Visit the Navy Federal prequalification page and login with your online access (enter username and password) See the image below;

Step #3: After a successful login, fill in the form available to you and submit it. You’ll need to provide some basic information, such as your name, address, and income, to see which card you’re eligible for.

If you’re prequalified for the Navy Federal Prequalification Credit Card, you can then complete the full application process. This will require more detailed information about your income, employment, and credit history.

Conclusion

The Navy Federal Prequalification Credit Card is a great option for military personnel, veterans, and their families. With no annual fee, competitive interest rates, a rewards program, and military-specific benefits, it offers a range of features that can help you save money and make the most of your credit card usage. By prequalifying for the card, you can see if you’re eligible without impacting your credit score, making it a smart choice for anyone looking for a new credit card.

References: With information from Navyfederal.org