What is the best financial reporting software? Financial reporting is a crucial aspect of business management. It involves analyzing financial data to make informed decisions and ensure financial stability. However, traditional financial reporting methods can be time-consuming and error-prone. To avoid these challenges, businesses use financial reporting software to automate the process.

In this guide, we’ll look at the best financial reporting software available in 2023.

Criteria for choosing the best financial reporting software

To determine the best financial reporting software, we considered the following criteria:

- User-friendly interface: The software should have an intuitive user interface that makes it easy to use for people with minimal or no accounting experience.

- Customizable report templates: The software should have pre-built templates that can be customized to suit a business’s unique needs.

- Integration with other financial software: The software should be able to integrate with other financial software to streamline the reporting process.

- Security features: The software should have security features that protect sensitive financial data.

- Affordable pricing plans: The software should offer pricing plans that are affordable for businesses of all sizes.

- Real-time data reporting: The software should provide real-time financial data reporting to enable businesses to make informed decisions quickly.

Top Financial Reporting Software

Here are our top-ranked financial reporting software examples based on the criteria above. The following are the best financial reporting software options available in 2023:

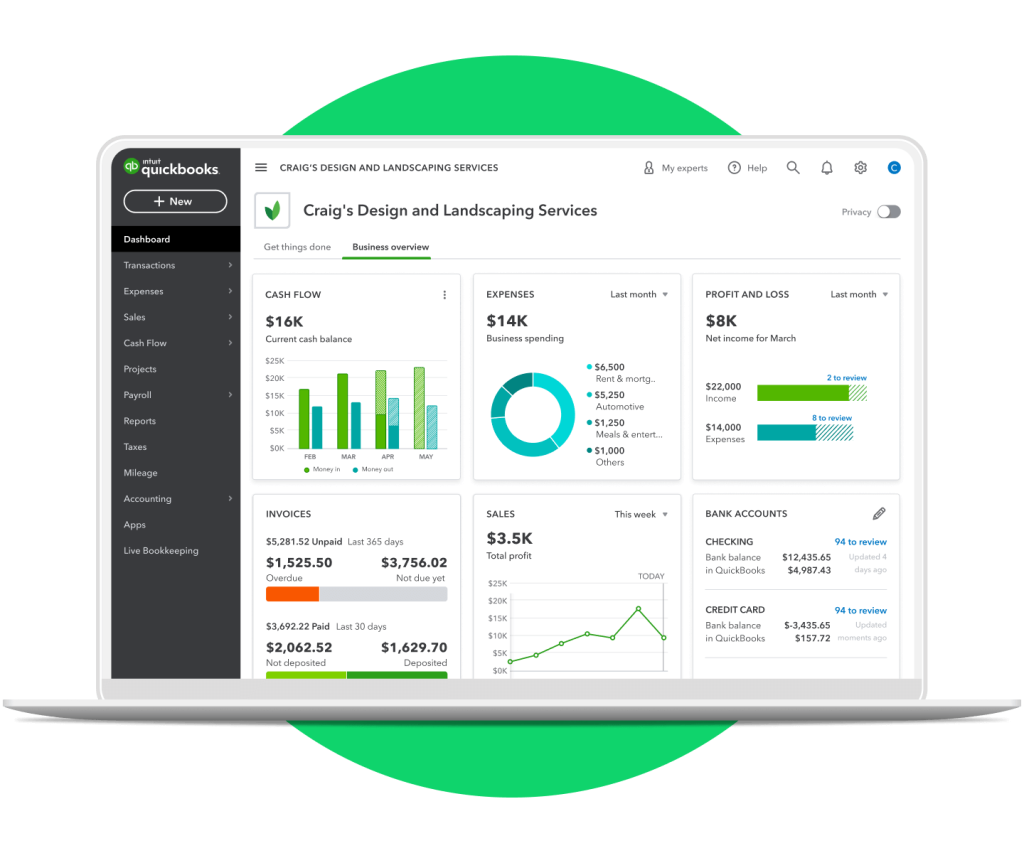

1. QuickBooks

QuickBooks is a cloud-based accounting software that is designed for small businesses. It was developed by Intuit and first released in 1983. QuickBooks offers a range of features that help businesses manage their financial data, including invoicing, expense tracking, financial reporting, and more.

Features

QuickBooks offers a range of features that make it easy for businesses to manage their financial data. Some of the key features include:

- Invoicing: QuickBooks allows businesses to create and send invoices to customers. Users can customize their invoices and track payment statuses.

- Expense tracking: QuickBooks makes it easy for businesses to track their expenses. Users can take photos of receipts and categorize their expenses, making it easy to generate expense reports.

- Financial reporting: QuickBooks offers a range of financial reporting features, including income statements, balance sheets, and cash flow statements. Users can generate reports in real-time, making it easy to analyze their financial data.

- Integration with other software: QuickBooks can integrate with other software, including payment processors, time-tracking software, and more. This makes it easy for businesses to manage their financial data in one place.

Pros and cons

Pros:

- User-friendly interface that is easy to navigate

- Offers a range of features to manage financial data

- Integrates with other software to streamline financial processes

- Provides real-time financial reporting

Cons:

- Customer support can be slow to respond

- Limited customization options for some features

- Advanced reporting features may require additional fees or add-ons

Pricing plans

QuickBooks offers several pricing plans to suit different business needs:

- Simple Start: $25 per month for basic bookkeeping features, including invoicing, expense tracking, and financial reporting.

- Essentials: $40 per month for additional features, including bill management, time tracking, and multiple users.

- Plus: $70 per month for advanced features, including inventory management, project tracking, and 1099 contractor management.

- Advanced: $150 per month for additional features, including advanced reporting, custom user permissions, and priority customer support.

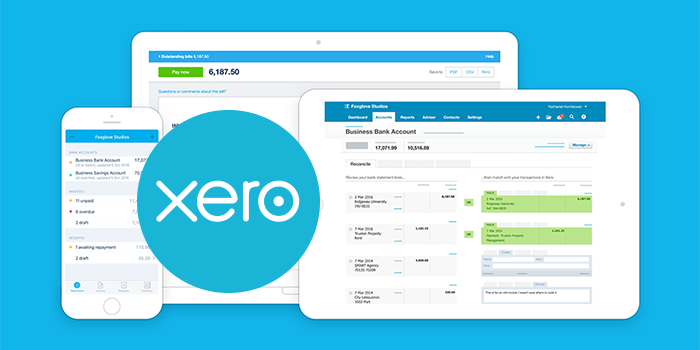

2. Xero

Xero is a cloud-based accounting software that is designed for small to medium-sized businesses. It was developed in New Zealand in 2006 and has since become a popular choice for businesses around the world. Xero offers a range of features that help businesses manage their financial data, including invoicing, expense tracking, financial reporting, and more.

Features

Xero offers a range of features that make it easy for businesses to manage their financial data. Some of the key features include:

- Invoicing: Xero allows businesses to create and send invoices to customers. Users can customize their invoices and track payment statuses.

- Expense tracking: Xero makes it easy for businesses to track their expenses. Users can take photos of receipts and categorize their expenses, making it easy to generate expense reports.

- Financial reporting: Xero offers a range of financial reporting features, including income statements, balance sheets, and cash flow statements. Users can generate reports in real-time, and this makes it easier to analyze financial data.

- Integration with other software: Xero can integrate with other software, including payment processors, time-tracking software, and more. This makes it easy for businesses to manage their financial data in one hub.

Pros and cons

Pros:

- User-friendly interface that is easy to navigate

- Offers a range of features to manage financial data

- Integrates with other software to streamline financial processes

- Provides real-time financial reporting

Cons:

- Customer support can be slow to respond

- Limited customization options for some features

- Some users have reported occasional syncing issues with bank accounts

Pricing plans

Xero offers several pricing plans to suit different business needs:

- Early: $11 per month for basic bookkeeping features, including invoicing and expense tracking.

- Growing: $32 per month for additional features, including project tracking, inventory management, and multiple users.

- Established: $62 per month for advanced features, including multi-currency support, bill management, and payroll.

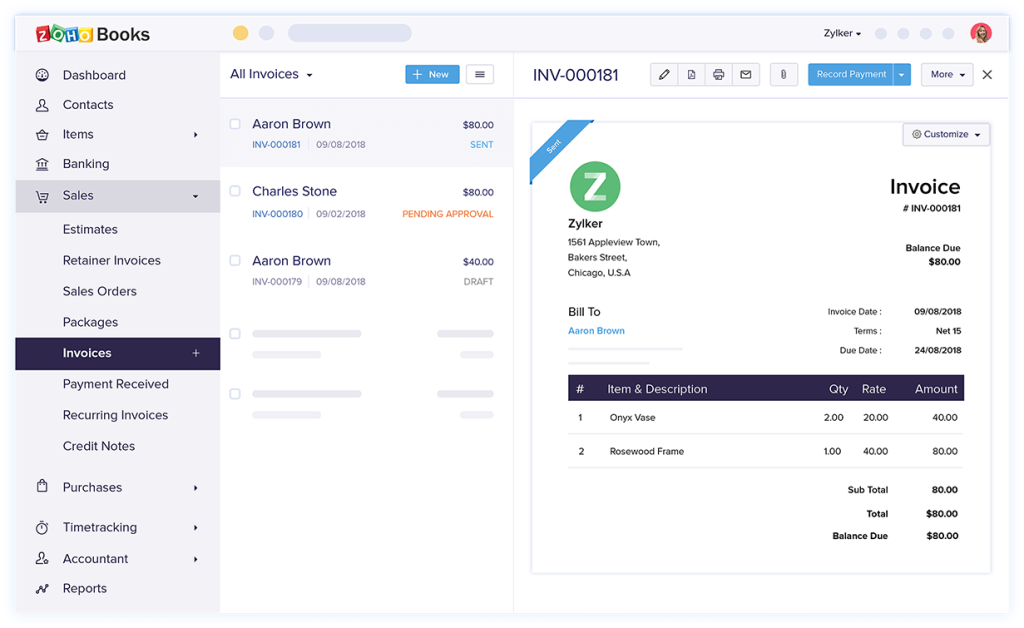

3. Zoho Books

Zoho Books is a cloud-based accounting software that is designed for small to medium-sized businesses. It was developed by Zoho Corporation, an Indian software development company that offers a suite of cloud-based business software. Zoho Books offers a range of features that help businesses manage their financial data, including invoicing, expense tracking, financial reporting, and more.

Features

Zoho Books offers a range of features that make it easy for businesses to manage their financial data. Some of the key features include:

- Invoicing: Zoho Books allows businesses to create and send invoices to customers. Users can customize their invoices and track payment statuses.

- Expense tracking: Zoho Books makes it easy for businesses to track their expenses. Users can take photos of receipts and categorize their expenses, making it easy to generate expense reports.

- Financial reporting: Zoho Books offers a range of financial reporting features, including income statements, balance sheets, and cash flow statements. Users can generate reports in real-time, making it easy to analyze financial data.

- Integration with other software: Zoho Books can integrate with other software, including payment processors, time-tracking software, and more.

Pros and cons

Pros:

- User-friendly interface that is easy to navigate

- Offers a range of features to manage financial data

- Integrates with other software to streamline financial processes

- Provides real-time financial reporting

Cons:

- Limited customization options for some features

- Some users have reported occasional glitches in the software

- Customer support can be slow to respond

Pricing plans

Zoho Books offers several pricing plans to suit different business needs:

- Basic: $9 per month for basic bookkeeping features, including invoicing, expense tracking, and financial reporting.

- Standard: $19 per month for additional features, including project tracking, recurring invoices, and customer credits.

- Professional: $29 per month for advanced features, including purchase order management, vendor credits, and inventory management.

- Premium: $39 per month for additional features, including workflow automation, custom fields, and custom roles.

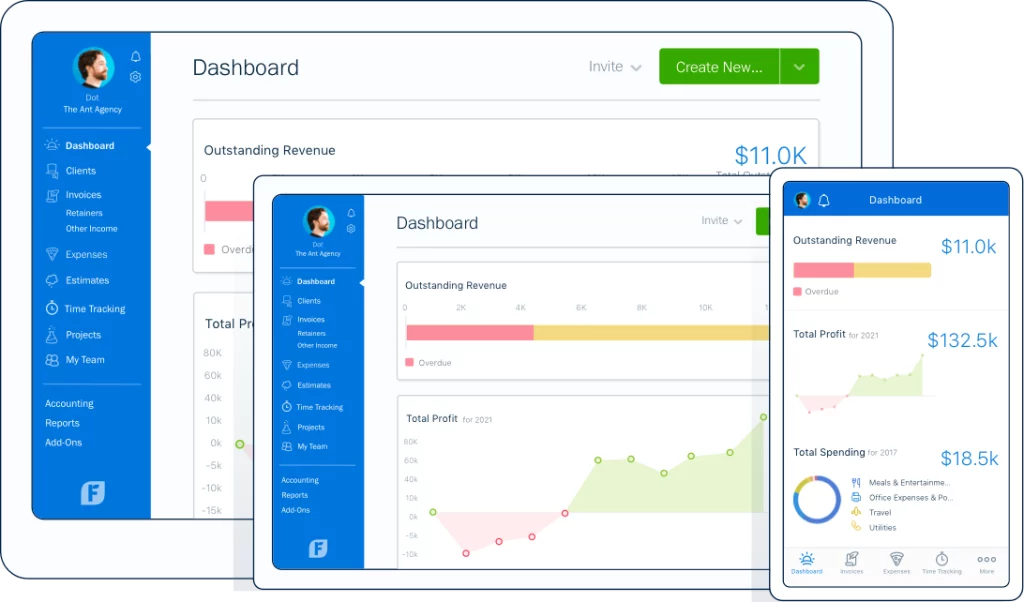

4. FreshBooks

FreshBooks is a cloud-based accounting software that is designed for small businesses. It was first released in 2003 and has since become a popular choice for businesses around the world. FreshBooks offers a range of features that help businesses manage their financial data, including invoicing, expense tracking, time tracking, financial reporting, and more.

Features

FreshBooks offers a range of features that make it easy for businesses to manage their financial data. Some of the key features include:

- Invoicing: FreshBooks allows businesses to create and send invoices to customers. Users can customize their invoices, track payment statuses, and automate payment reminders.

- Expense tracking: FreshBooks makes it easy for businesses to track their expenses. Users can take photos of receipts and categorize their expenses, making it easy to generate expense reports.

- Time tracking: FreshBooks offers a built-in time tracking feature, making it easy for businesses to track billable hours for projects.

- Financial reporting: FreshBooks offers a range of financial reporting features, including income statements, balance sheets, and cash flow statements. Users can generate reports in real-time, making it easy to analyze their financial data.

Pros and cons

Pros:

- User-friendly interface that is easy to navigate

- Offers a range of features to manage financial data

- Automates payment reminders and recurring invoices

- Provides real-time financial reporting

Cons:

- Limited customization options for some features

- Some users have reported occasional issues with the mobile app

- Advanced features, such as project management, are only available on higher-tier plans

Pricing plans

FreshBooks offers several pricing plans to suit different business needs:

- Lite: $6 per month for basic invoicing features, including unlimited invoices, estimates, and time tracking.

- Plus: $10 per month for additional features, including recurring invoices, automated payment reminders, and late payment fees.

- Premium: $20 per month for advanced features, including proposals, projects, and team time tracking.

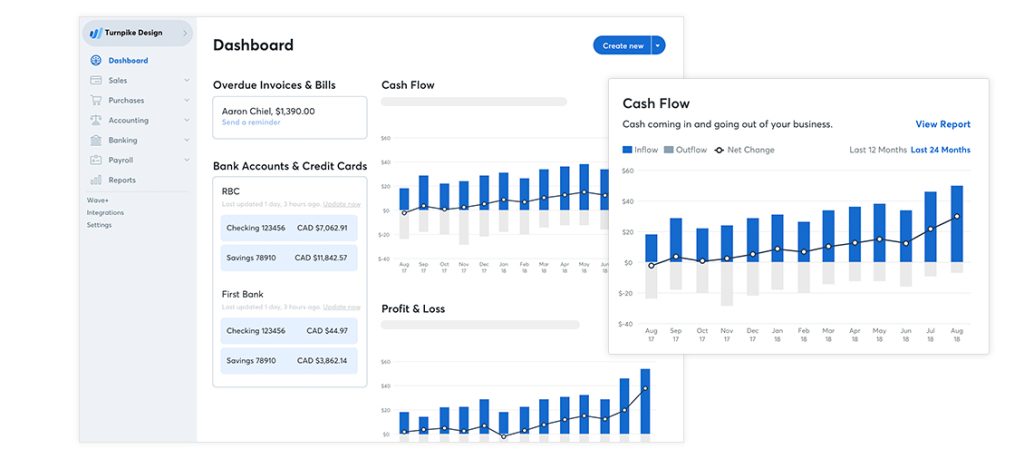

5. Wave Financial

Wave Financial is a financial accounting software for small businesses. It was first released in 2010 and has since become a popular choice for businesses around the world. Wave offers a range of features that help businesses manage their financial data, including invoicing, expense tracking, payroll, and more.

Features

Wave offers a range of features that make it easy for businesses to manage their financial data. Some of the key features include:

- Invoicing: Wave allows businesses to create and send professional-looking invoices to customers. Users can customize their invoices, track payment statuses, and set up recurring invoices.

- Expense tracking: Wave makes it easy for businesses to track their expenses. Users can take photos of receipts and categorize their expenses, making it easy to generate expense reports.

- Payroll: Wave offers a payroll feature, making it easy for businesses to manage their employees’ payroll and taxes.

- Financial reporting: Wave offers a range of financial reporting features, including income statements, balance sheets, and cash flow statements. Users can generate reports in real-time, making it easy to analyze their financial data.

Pros and cons

Pros:

- User-friendly interface that is easy to navigate

- Offers a range of features to manage financial data

- Offers a payroll feature for easy employee management

- Provides real-time financial reporting

Cons:

- Limited customization options for some features

- Some users have reported occasional syncing issues with bank accounts

- Advanced features, such as project management, are not available on the platform

Pricing plans

Wave offers a range of pricing plans, including a free plan for businesses with basic accounting needs:

- Free: Includes invoicing, expense tracking, and financial reporting.

- Payroll: Starts at $20 per month plus $4 per employee, offering a payroll feature for easy employee management.

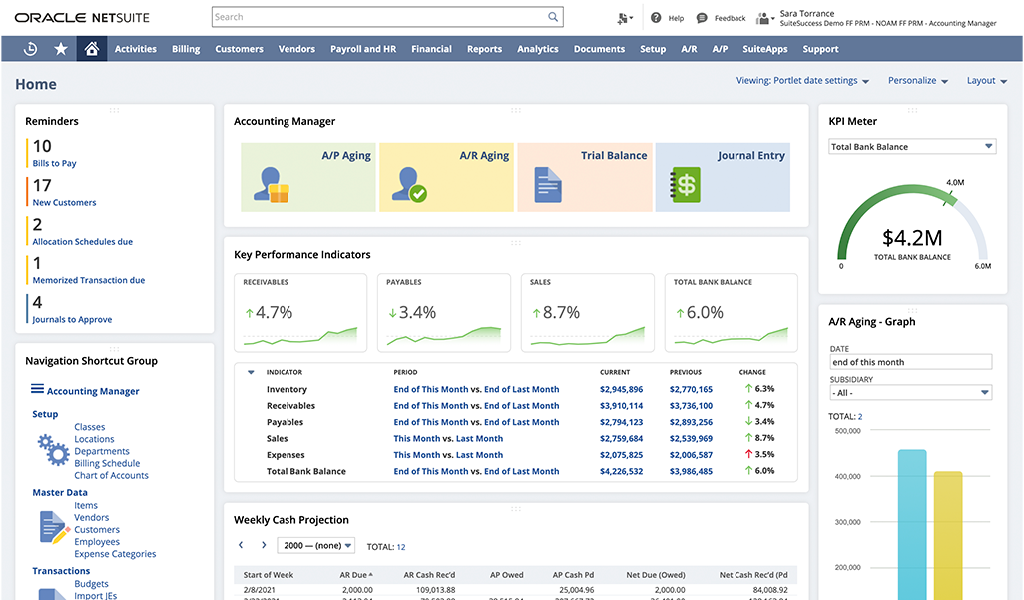

6. NetSuite

Oracle NetSuite is a cloud-based business management software that is designed for small and medium-sized businesses. It was first released in 1998 and has since become a popular choice for businesses around the world. NetSuite offers a range of features that help businesses manage their financial data, including financial management, customer relationship management, inventory management, and more.

Features

NetSuite offers a range of features that make it easy for businesses to manage their financial data. Some of the key features include:

- Financial management: NetSuite offers financial management features, including general ledger, accounts payable, accounts receivable, and financial reporting.

- Customer relationship management: NetSuite offers customer relationship management features, including customer records, sales forecasting, and customer service management.

- Inventory management: NetSuite offers inventory management features, including real-time inventory visibility, inventory replenishment, and demand planning.

- E-commerce: NetSuite offers e-commerce features, including online store management, order management, and payment processing.

Pros and cons

Pros:

- Offers a range of features to manage financial data and business operations

- Provides real-time financial reporting and analytics

- Integrates with other popular business applications, including Salesforce and Shopify

- Offers customizable dashboards and reporting tools

Cons:

- Can be complex to set up and use

- Pricing can be expensive for small businesses

- May require additional customization to meet specific business needs

Pricing plans

NetSuite does not publish its pricing plans on its website, as each plan is customized based on the specific needs of the business. However, pricing typically starts at around $999 per month and can increase based on the size and complexity of the business.

What are the benefits of financial reporting software?

Financial reporting software provides a range of benefits to businesses, including

- Time-saving: Financial reporting software automates the process of generating financial reports, which saves time compared to manual reporting methods. The Software can generate reports in real-time, eliminating the need for manual data entry and reducing the risk of errors.

- Increased accuracy: Financial reporting software reduces the risk of human errors that can occur during manual data entry. The software ensures accuracy by using automated calculations and formulas.

- Customizable reports: Financial reporting software provides customizable report templates, allowing businesses to create reports that meet their specific needs. The software can generate different types of reports, including income statements, balance sheets, cash flow statements, and more.

- Better data analysis: Financial reporting software provides businesses with a better understanding of their financial data. The software can generate reports that show trends, patterns, and anomalies, making it easier for businesses to analyze their financial data and make informed decisions.

- Improved collaboration: Financial reporting software allows multiple users to access financial data simultaneously, improving collaboration and reducing the risk of errors. Users can also share reports with other team members, ensuring everyone has access to the same information.

- Integration with other financial software: Financial reporting software can integrate with other financial software, such as accounting and ERP systems, allowing businesses to streamline their financial processes and eliminate manual data entry.

Conclusion

Businesses that want to speed up their financial reporting process must choose the right software for financial reporting. The best financial reporting software for your business will depend on your unique needs and budget. We recommend QuickBooks for small businesses, Xero and Zoho Books for mid-sized businesses, and NetSuite for larger businesses. But it’s important to compare the features and pricing plans of each software before making a choice.